Mortgage

With more than 25 years in the mortgage industry, I bring a well-rounded background that includes hands-on experience as a Processor, Underwriter, Mortgage Lender Area Manager, and since 2010 as a Licensed Mortgage Broker.

This comprehensive knowledge allows me to understand every detail of the loan process—from the paperwork to the approval—so I can guide you smoothly from application to closing with confidence and precision.

As a broker, I work for you, not the banks, leveraging a wide network of lenders to find the best rates and loan solutions tailored to your needs—whether you’re a first-time buyer, refinancing, investing, or rebuilding credit.

I don’t just get loans approved—I build strategies that help you save money, grow wealth, and reach your homeownership goals.

With experience on all sides of the lending table, I know how to move your loan forward efficiently and successfully.

1. Full Income & Assets Documentation

To qualify for a mortgage, you’ll need to provide thorough documentation of your income and assets. This includes one month of paystubs, two years of W-2 forms, and two years of tax returns. You’ll also need to supply two months of bank statements showing the sourcing and seasoning of funds for your down payment and closing costs.

2. Credit Report

3. Derogatory Credit Items

If you have late payments, unresolved tax liens, judgments, collections, or an excessive number of recent credit inquiries, it will affect your loan approval. It’s essential to avoid new credit inquiries and any negative credit activity until your mortgage is finalized to maintain your loan approval status.

4. Existing Credit Balance to Limit

For the best results, the balances on your existing revolving credit should not exceed 35% of their maximum limits. It’s advisable not to pay down or pay off these balances during the application process.

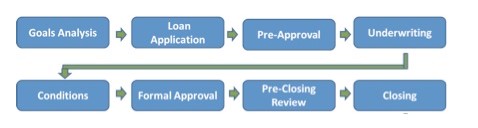

5. Entire Process

The complete mortgage application process typically takes around 45-60 days. The timeline depends on the timely cooperation of all parties involved, including realtors and borrowers. Several steps are involved, such as signing the mortgage application package, house inspections, appraisal, title work, obtaining home insurance, and satisfying the lender’s conditions.

6. Mortgage Approval

After the borrowers sign the mortgage package, it typically takes 4-7 days to receive approval from the lender. However, this approval comes with certain conditions that need to be met. Borrowers are strongly advised to promptly fulfill these conditions, ideally within 24 hours of receiving the request. The lender may take 48-72 hours (and possibly longer toward the end of the month) to review these conditions. Additionally, the lender reserves the right to request further conditions if necessary.

7. Rate

The initial application rate is an estimated rate used for calculating income-to-debt ratios and estimating the mortgage payment. The final rate is locked in after the loan receives approval. This rate lock is typically valid for 30 days. To prevent the rate from expiring, it should be locked within the last 30 days of the real estate contract.

8. Fees

There are two types of fees involved. The first is the appraisal fee, which is paid in advance by the lender. It’s typically ordered within 7-14 days of the date the mortgage package was signed and takes an additional week to complete. The second fee is an inspection fee, usually covered on the real estate side. It should be conducted within 14 days of the real estate contract date.

9. Borrower's Responsibilities

Borrowers have essential responsibilities during the mortgage process. This includes cooperating by providing requested conditions in a timely manner. Additionally, maintaining open communication, both verbal and written (via email or text), with the assistant and mortgage professional throughout the entire mortgage process is crucial.