Business

I offer several lending vehicles available based on your unique business and credit profile.

This section is to give you a brief of what I will share in the BLOG to the right (drop down box) regarding the latest news on business loans, business cash flow line of credits, and working capital loans.

UNSECURED BUSINESS LINES OF CREDIT / FUNDING

BUSINESS CASH ADVANCES

It is more difficult than ever for businesses to get the working capital they need, the small business financing programs I offer, focuses on business owners who may no longer meet bank financing requirements and falling below their bank’s credit requirements. I can access capital for your business that credit unions, home equity loans and commercial banks wont give you access to due to the lending restrictions over the past several years.

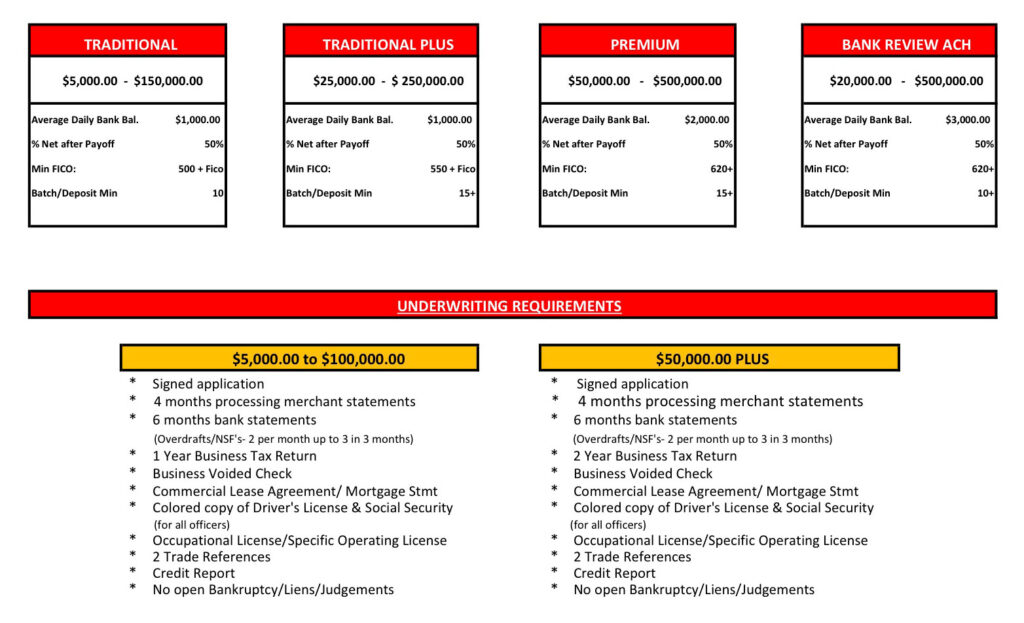

With the lenders I have to meet your business capital needs, advances from $5,000 to up to $500,000 are available for small business owners. They focused on the business’s historical cash flow and performance allowing them to expand and be flexible in the lending standards.

CASH FLOW LOANS

Cash flow loans are generally unsecured loans, whereby the lender looks to anticipated cash flow to repay the loan and requires certain financials and non financial covenants be met. With this type of loan, you take advantage of the reliability and regularity of your company’s revenue streams.

Do you need money for your business to do any of the following?:

- Expand your business

- Open a new business

- Pay for last minute expenses

- Buy Equipment or inventory

- Advertise or Develop new products

Then, you need to be talking to me! Call me to guide you and get you the need your business so much needs!

A FAST, SMART SOLUTION IN OBTAINING WORKING CAPITAL FOR YOUR SMALL BUSINESS BY PROVIDING:

- Streamlined application process with reduced documentation requirements

- Flexible terms for all credit types

- Fair and affordable repayment terms with no application fees

- Higher approval rates then bank loans and decision within 5 business days from completed application

- Easy renewal terms

working capital matrix