There are different steps to start the wonderful journey to home ownership, here I will point out the process which I use to help my clients understand and learn about credit and its formulas.

Step #1 and 1 of the MOST IMPORTANT elements to qualify for a Mortgage Loan is Credit.

In our 1st meeting as a Mortgage Banker Specialist, I would ask you for permission (in writing) to pull your credit report and thus analyze it with you to guide you to the next steps which could be MOVING ON to the next step:

Step #2 (on the pre-qualification process) gather the documents needed to calculate and verify the income, assets and come out with the client’s purchasing power and maximum mortgage loan amount (Che LICK HERE to see those requirements)

Or continue to do a Credit Analysis (below) to help client identify key elements missing in the credit report to have the best potential credit scores to access the best rates, financing programs and over all the best financial options in what a call a VIP Status Credit Profile!

Step #2 (Credit Analysis) is broken in 2 further steps:

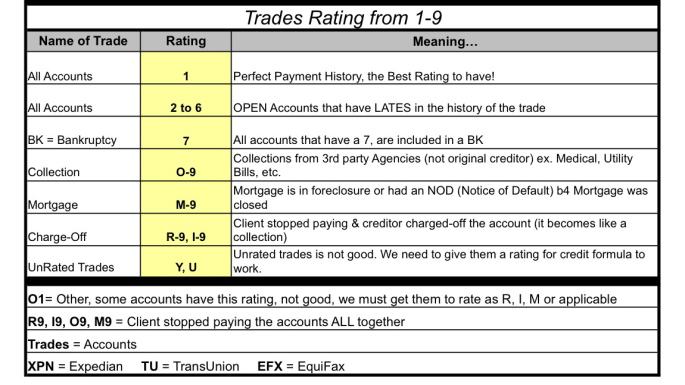

- Educate client on how the credit bureaus work, the meaning of the different letters on the credit ex. R, I, M as well as the Ratings ex. 1, 2-6, 7, O-9, M-9, R-9, I-9, Y and U. Explain how the credit scores formula works to achieve the best scores for the client. (PARTIAL VIEW of the Credit Education)

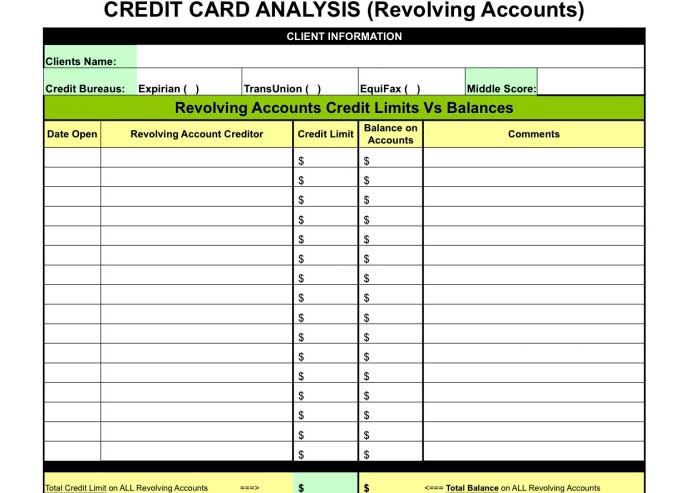

Do the Revolving Credit Analysis, calculating the Credit Limits vs Balance Limits, multiple them by a % that would help understand why the scores as as present and how to achieve better scores by improving this formula to work for (not against) the client. (PARTIAL VIEW of the form used to analyze the Revolving Credit)