There are different terms used for both; individuals working for a bank who also offers mortgage loans and individuals working for a brokerage mortgage company.

The terms are: Loan Officer, Mortgage Broker, Mortgage Banker, Mortgage Specialist, Mortgage Lender and Mortgage Originator.

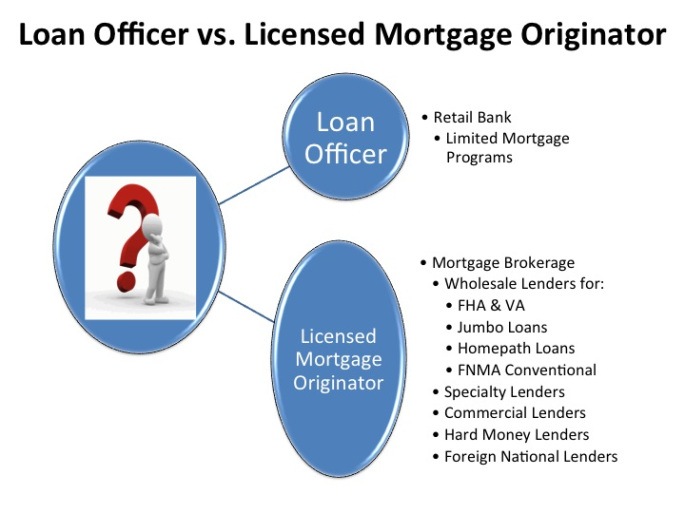

But for the purposes of the explanation here, we will use only the term Loan Officer for those individuals working for a local Bank or Credit Union and Licensed Mortgage Originator for those individuals who work for a mortgage producing entity (either a broker or a lender).

The most important difference between a Loan Officer and a Licensed Mortgage Originator is their education to start this career and every year for the rest of the mortgage career.

A Loan Officer is hired by the bank or credit union does the screening needed to get hired (only 1 time) and gets internal training for the job, NO State license or education required.

A Licensed Mortgage Originator has to pass a mortgage course, school and State tests, gets his credit report reviewed, background check, finger prints and pay a State license fee to be able to originate loans and work with the public. Plus a Licensed Mortgage Originator has to attend and pass a yearly course and re-do all the checks above to renew his/her license. Once licensed, we become part of the NMLS (National Mortgage Licensing System) in accordance to the S.A.F.E act (The Secured and Fair Enforcement for Mortgage Licensing act of 2008).

Another difference is that the Loan Officer working for a local bank or credit union is an employee paid by that bank to originate mortgage loans and only to sell the bank’s own limited mortgage programs. They are a representative for the source of the funds, in this case a bank directly who is lending the money on the transaction..

A Licensed Mortgage Originator works for a mortgage brokerage and is employed by that broker, not a specific bank. We don’t representing a company that is lending the money on the transaction. We are an intermediary whose job it is to arrange financing. We work with multiple funding sources, banks, mortgage lenders, private lenders, etc. and have access to all different rates in the market to choose the best for our clients. It is our job to shop a loan package to find funding for it.

Here is the BIGGEST DIFFERENCE of all! Here are the programs we; as Licensed Mortgage Originators can offer to our clients:

PURCHASE AND REFINANCE TRANSACTIONS

RESIDENTIAL AND COMMERCIAL PROPERTIES

CONFORMING – FANNIE MAE – UP TO $417,000

JUMBO LOANS UP TO 30 MILLION

FOREIGN NATIONAL

FHA – UP TO $423.500

FHA 203K – RENOVATION

VA LOANS (for Veterans)

HARD EQUITY – PRIVATE INVESTORS

HOMEPATH PROPERTIES FOR RENOVATION

CONDO FINANCING – FULL & LIMITED REVIEW

HOMEPATH – HOUSE/CONDO’S OWNER OCCUPIED UP TO 95%

HARP – HOME AFFORDABLE REFINANCE PROGRAM UP TO 150% LTV

BUY & REHAB PROGRAM – UP TO 20 PROPERTIES AND FINDS TO REHAB EACH OF THEM

***NON PRIME LOANS – 500+ CREDIT SCORES, SHORT SALE, FORECLOSURE, BK AFTER 1 DAY***

I am a Licensed Mortgage Originator, please call me if you need my help. 305-206-5144