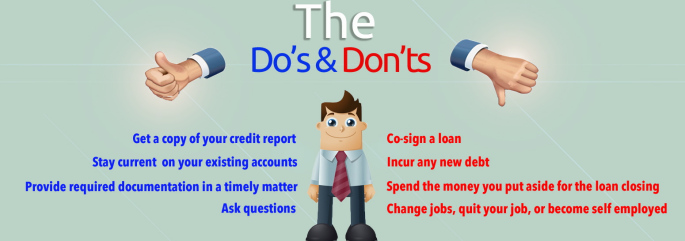

There are many things that can go wrong in the mortgage approval process, so here is a loan checklist of Do’s and Don’ts to help you avoid problems.

- Do continue making your rent payments.

- Do stay current on all your existing credit cards and other accounts.

- Do keep working at your current employer. (Yes, some people quit their jobs while getting a loan!)

- Do keep the same insurance company.

- Do continue using credit as usual (as long as “usual” means paying on time!)

- Do call your lender if you have questions or want to change your finances in any way.

These Do’s and Don’ts are just before & during the mortgage process. Once you have the loan, you can return to normal!

- Don’t make any major purchases. (car, furniture, refrigerator, etc.)

- Don’t apply for new credit. (even if you’re “preapproved”)

- Don’t open a new credit card.

- Don’t transfer credit card balances.

- Don’t pay charge offs. (unless your lender says to do it)

- Don’t pay off any collections. (you guessed it- ask your lender first)

- Don’t close any credit card accounts.

- Don’t increase your credit card debt.

- Don’t change bank accounts.

- Don’t consolidate debt or credit cards.

- Don’t take out a new loan. (yeah, people have done it)

- Don’t open a new cell phone account – or any new accounts!

- Don’t pay off loans or credit cards unless your lender says its ok.

Its probably becoming clear that the best rule is “Don’t Change Anything!” unless you talk to your lender first. Refer to this loan checklist of do’s and don’t often.